Bill Validators for Vending Machines: The Complete Guide

For vending machine operators, accepting cash securely and efficiently is one of the most important aspects of running a profitable business. While cashless payment options such as mobile wallets and credit cards have grown in popularity, many customers still prefer the simplicity of paying with paper currency. This is where bill validators, also known as bill acceptors, play a central role. They allow vending machines to accept cash, verify its authenticity, and provide accurate credit for purchases. By ensuring smooth transactions, bill validators not only maximize revenue but also improve the overall customer experience.

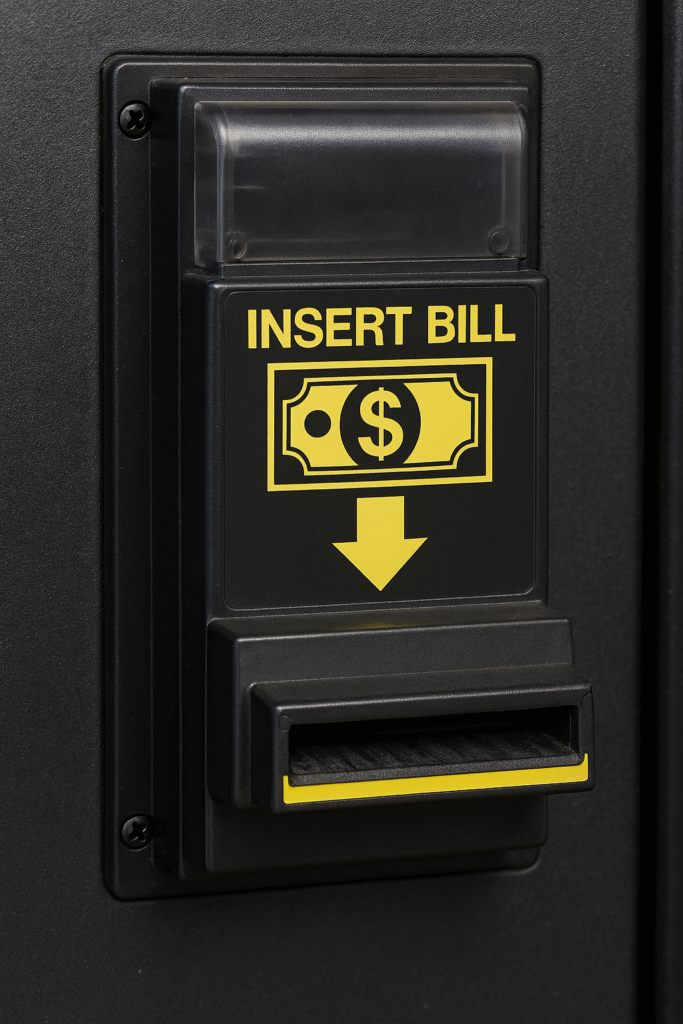

A bill validator is essentially the gatekeeper of cash transactions inside a vending machine. When a customer inserts a bill, the validator uses a series of sensors to check for authenticity. These sensors analyze the size of the bill, its magnetic properties, and printed security features to confirm that it is genuine. Once verified, the machine credits the amount to the customer’s purchase, allowing them to select their desired product. Modern bill validators are designed to handle multiple denominations, detect counterfeit bills, and even update their firmware to recognize new currency designs. This adaptability ensures that machines remain reliable even as currency evolves.

Choosing the right bill validator requires careful consideration of several factors. Machine compatibility is essential, as not all validators fit every vending machine model. Accepted denominations also matter, since some validators may only handle lower value bills while others can process higher denominations. Reliability is another key factor, as a validator that frequently rejects valid bills or suffers from jams can frustrate customers and reduce sales. Ease of maintenance should also be considered, since operators need to clean and update these devices regularly. Popular brands such as MEI, Pyramid, and JCM are widely trusted in the industry for their durability and precision, making them common choices among operators who want dependable performance.

Maintenance is critical to keeping bill validators functioning properly. Dust, dirt, and worn bills can interfere with sensors, leading to frequent rejections or mechanical failures. Cleaning the sensors with manufacturer approved cleaning cards or solutions every month or two helps maintain accuracy, especially in high traffic locations. Firmware updates are equally important, as they allow validators to recognize new bill designs and prevent issues with outdated currency recognition. Operators should also periodically check wiring, coin boxes, and mechanical components to prevent malfunctions and extend the lifespan of the device. A well maintained validator not only reduces downtime but also ensures that customers enjoy a smooth transaction every time.

Beyond efficiency, bill validators also enhance security. They reduce the need for operators to manually process cash, keeping bills securely stored inside the machine until collection. This minimizes the risk of theft and ensures accurate accounting of revenue. For operators managing multiple machines, validators integrated with telemetry systems can report cash levels remotely. This feature allows operators to plan restocking routes more effectively, reducing unnecessary trips and lowering operational costs. By combining secure cash handling with smart technology, bill validators provide both peace of mind and practical benefits.

Even in today’s increasingly cashless environment, bill validators remain essential. Many customers, particularly in schools, hospitals, and public spaces, still prefer to pay with cash. By offering both cash and cashless options, operators can maximize revenue and cater to a wider audience. Ignoring cash payments could mean losing a significant portion of potential sales, especially in areas where card or mobile payments are less common. A reliable bill validator ensures that cash paying customers are not left out, keeping vending machines accessible to everyone.

The future of bill validators is closely tied to advancements in vending technology. As machines become smarter and more connected, validators are evolving to integrate seamlessly with telemetry systems, mobile payment platforms, and advanced security features. Some models now include self diagnostic tools that alert operators to potential issues before they cause downtime. Others are designed to be more energy efficient, reducing operating costs while maintaining performance. These innovations highlight the ongoing importance of bill validators in a vending industry that continues to adapt to changing consumer habits.

For operators, investing in a high quality bill validator is not just about handling cash. It is about ensuring customer satisfaction, protecting revenue, and maintaining the reputation of their vending business. A machine that consistently rejects valid bills or suffers from frequent malfunctions can quickly frustrate customers and drive them away. On the other hand, a machine equipped with a reliable validator creates a seamless experience that encourages repeat use. By combining proper machine selection, routine maintenance, and smart technology integration, operators can build a vending business that is both profitable and customer friendly.

FAQ: Bill Validators for Vending Machines

Q1: What denominations do bill validators accept?

A: Most modern bill validators accept bills from $1 up to $20, and some can be updated to handle newer designs.

Q2: How often should I clean a bill validator?

A: Cleaning is recommended every 1–2 months, or more often in high traffic locations, to prevent sensor issues.

Q3: Why does a bill validator sometimes reject valid bills?

A: This can occur due to dirty sensors, worn or crumpled bills, or outdated firmware. Regular cleaning and updates usually solve the problem.

Q4: Can bill validators be installed in older vending machines?

A: Yes, although compatibility depends on the machine’s design. Some retrofitting may be required to integrate modern validators.

Q5: Are bill validators still necessary in cashless environments?

A: Yes. Many customers still prefer paying with cash, so offering both cash and cashless options maximizes revenue and customer satisfaction.

Investing in a reliable bill validator is one of the smartest decisions a vending machine operator can make. These devices ensure smooth, secure cash transactions, protect against counterfeit bills, and improve the customer experience. By choosing the right model, performing routine maintenance, and keeping the device updated, operators can reduce downtime, safeguard their revenue, and maintain a vending business that meets the needs of both cash and cashless customers. As the vending industry continues to evolve, bill validators remain a vital part of ensuring accessibility, efficiency, and profitability.

Check out some of our other articles:

Vending Machine Initial Investment and ROI Expectations

Starting a vending machine business is an appealing way to generate passive income…

Cantaloupe vs Nayax: Choosing the Right Vending Machine Payment System

For vending machine operators, selecting the right cashless payment system is crucial…

Dixie Narco 501E Vending Machine Review: Features, Pros, and Cons

The Dixie Narco 501E vending machine is a widely recognized choice for operators seeking…